by Calculated Risk on 11/05/2018 08:29:00 AM

Monday, November 05, 2018

Black Knight Mortgage Monitor: Foreclosure Inventory Falls to Pre-Recession Average

Black Knight released their Mortgage Monitor report for September today. According to Black Knight, 3.97% of mortgages were delinquent in September, down from 4.40% in September 2017. Black Knight also reported that 0.52% of mortgages were in the foreclosure process, down from 0.70% a year ago.

This gives a total of 4.49% delinquent or in foreclosure.

Press Release: Black Knight: Interest Rate Increases Cut Refinanceable Population by More than Half in 2018; Housing in 10 States Now Less Affordable than Long-Term Benchmarks

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based on data as of the end of September 2018. This month’s report looks at the continued impact of rising interest rates on both the refinanceable population – homeowners with mortgages who could likely qualify for and see at least a 0.75 percent rate reduction from a refinance – and home affordability. As Ben Graboske, executive vice president of Black Knight’s Data & Analytics division explained, over the last two years, millions of homeowners lost an interest rate incentive to refinance.

“Due to rising rates, some 6.5 million homeowners that previously could have benefited from refinancing their mortgages have missed that opportunity,” said Graboske. “On average, these homeowners had a 22-month window to refinance. …"

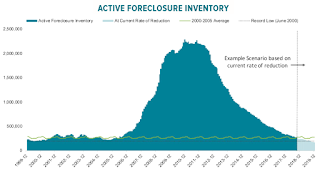

This month’s data also showed that the national inventory of loans in active foreclosure has fallen to pre-recession averages for the first time since the financial crisis. The improvement is actually even more impressive than it may seem. Taking into account today’s foreclosure rate and the fact that there are 16 percent more active mortgages today than the 2000-2005 average, relatively speaking, foreclosure inventory is actually 40,800 below pre-recession "norms.” At the current rate of reduction (a six-month average annual decline of 27 percent) active foreclosure inventory would hit a record low in September 2019, with fewer than 200,000 cases nationwide.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor showing active foreclosure inventory.

From Black Knight:

• The number of loans in active foreclosure continues to decline at a rapid pace, with some 90K fewer (-25%) active foreclosure cases from one year agoThere is much more in the mortgage monitor.

• September marks the lowest foreclosure inventory since mid-2006 and the first time since the financial crisis that the number of active foreclosures has fallen to pre-recession (2000-2005) averages

• Taking into account today’s foreclosure rate and the fact that there are 16% more active mortgages today than the 20002005 average, relatively speaking, foreclosure inventory is actually 41K below pre-recession "norms”

• At the current rate of reduction (a six-month average annual decline of 27%) active foreclosure inventory would hit a record low in September 2019, with fewer than 200K cases nationwide