by Calculated Risk on 1/12/2019 08:11:00 AM

Saturday, January 12, 2019

Schedule for Week of January 13th

Special Note on Government Shutdown: If the Government shutdown continues, then some additional releases will be delayed. For example, this coming week, the retail sales and housing starts reports will not be released if the government remains shutdown. (see bottom for key releases already delayed).

The key reports this week are December housing starts and retail sales.

For manufacturing, the December Industrial Production report and the January NY and Philly Fed manufacturing surveys will be released.

No major economic releases scheduled.

8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.2% increase in core PPI.

8:30 AM: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 12.0, up from 10.9.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.2% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.6% on a YoY basis.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 57, up from 54. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. This graph shows single and total housing starts since 1968.

The consensus is for 1.256 million SAAR, unchanged from 1.256 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 216 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 10.0, up from 9.4.

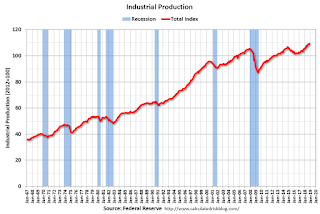

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.5%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 97.0.

10:00 AM: State Employment and Unemployment (Monthly) for December 2018

New Home Sales (Census) for November from the Census Bureau. The consensus was for 560 thousand SAAR, up from 544 thousand in October.

Construction Spending (Census) for November. The consensus was for a 0.3% increase in construction spending.

Light vehicle sales (BEA) for December. The consensus was for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).

Trade Balance report (Census) for November from the Census Bureau. The consensus was the trade deficit would be $53.9 billion. The U.S. trade deficit was at $55.5 billion in October.