by Calculated Risk on 2/04/2019 08:00:00 AM

Monday, February 04, 2019

Black Knight Mortgage Monitor for December

Black Knight released their Mortgage Monitor report for December today. According to Black Knight, 3.88% of mortgages were delinquent in December, down from 4.71% in December 2017. Black Knight also reported that 0.52% of mortgages were in the foreclosure process, down from 0.65% a year ago.

This gives a total of 4.40% delinquent or in foreclosure.

Press Release: BBlack Knight: Active Foreclosure Rate and Inventory End 2018 Below Pre-Recession Averages; Total Year Foreclosure Starts and Sales Hit More Than 18-Year Lows

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon its industry-leading loan-level mortgage performance database. With full-year mortgage performance data in, this month’s report looked at 2018 in review. As explained by Ben Graboske, president of Black Knight’s Data & Analytics division, more than a decade past the start of the financial crisis, most metrics reflect a recovery to their long-term, 2000-2005 pre-recession averages.

“Across the board, 2018 year-end numbers are good news from a mortgage performance perspective,” said Graboske. “All four major performance metrics – delinquencies, serious delinquencies, active foreclosures and total non-current inventory – ended the year below pre-recession averages for the first time since the financial crisis. Just 576,000 foreclosures were initiated throughout the entirety of 2018 – an 18-year low – and the vast majority of these were repeat actions. In fact, first-time foreclosures were down 18 percent from the year before, hitting the lowest point we’ve seen since Black Knight started reporting the metric in 2000. Even repeats – though making up more than 60 percent of all foreclosures – were down 6 percent from 2017.

“These year-end numbers are further proof of what we’ve been observing for some time now. The high credit quality and corresponding lower risk we’ve seen in the post-crisis origination market for the better part of a decade continues to pay dividends in terms of mortgage performance. In addition, the low interest rate environment we’ve enjoyed for so long had – until very recently – resulted in a refinance-heavy blend of originations for years. Refis, as a whole, tend to outperform their purchase mortgage counterparts, which has boosted mortgage performance as well. On top of that, we’ve had the benefit of strong employment and housing markets, which have helped the vast majority of homeowners meet their debt obligations, while those few who may have faced a possible default have gained enough equity to be able to sell rather than face foreclosure.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the year end delinquency rate over time.

From Black Knight:

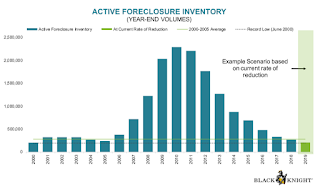

• While we’ve documented the potential impact of rising interest rates, and talk of a looming recession persists in the market, mortgage performance continues to strengthenThe second graph shows active foreclosure inventory over time.

• The national delinquency rate is down 18% from last year, though that figure is overstated due to hurricane-related effects over the past 18 months

• Still, even excluding hurricane-impacted areas, December's delinquency rate was down an impressive 11% from last year

• Both the national foreclosure rate and the number of loans in active foreclosure have now fallen below long-term normsThere is much more in the mortgage monitor.

• In fact, the national foreclosure rate closed out 2018 below its pre-crisis average for the first time since 2005

• While the rate of improvement has slowed slightly in recent months, at the current rate of decline, both metrics would be near record lows by the end of 2019