by Calculated Risk on 3/09/2019 08:11:00 AM

Saturday, March 09, 2019

Schedule for Week of March 10, 2019

The key reports this week are January New Home Sales, February CPI and January retail sales.

For manufacturing, the February Industrial Production report and the March NY Fed manufacturing survey will be released.

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for no change in retail sales.

8:30 AM: Retail sales for January is scheduled to be released. The consensus is for no change in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 2.9% on a YoY basis in December.

10:00 AM: State Employment and Unemployment (Monthly) for January 2019

6:00 AM ET: NFIB Small Business Optimism Index for February.

8:30 AM: The Consumer Price Index for February from the BLS. The consensus is for 0.2% increase in CPI, and a 0.2% increase in core CPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.8% decrease in durable goods orders.

8:30 AM: The Producer Price Index for February from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: Construction Spending for January. The consensus is for a 0.3% increase in construction spending.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 223 thousand the previous week.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 620 thousand SAAR, down from 621 thousand in December.

8:30 AM: The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 10.0, up from 8.8.

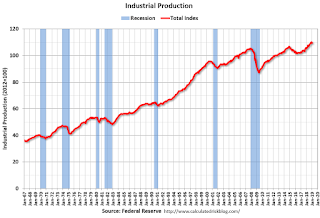

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for March).

10:00 AM ET: Job Openings and Labor Turnover Survey for January from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for January from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in December to 7.335 million from 7.166 million in November.

The number of job openings (yellow) were up 29% year-over-year, and Quits were up 4% year-over-year.