by Calculated Risk on 4/18/2019 01:11:00 PM

Thursday, April 18, 2019

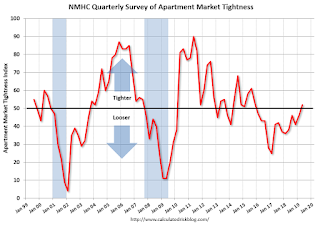

NMHC: Apartment Market Tightness Index Increased in April

The National Multifamily Housing Council (NMHC) released their April report: April NMHC Quarterly Survey Highlights Continued Strength of the Apartment Market

he apartment market showed signs of strengthening in the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for April 2019. The Market Tightness (52), Equity Financing (53), and Debt Financing (81) indexes were all above the breakeven level (50), while the Sales Volume index (45) improved, but still showed some continued softness on property sales.This index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. And it also helped me call the bottom in vacancy rate more recently.

“Even as overall economic growth slowed somewhat in the last quarter of 2018 and the first quarter of 2019, the apartment market has rallied,” noted NMHC Chief Economist Mark Obrinsky. “Thirty percent of respondents saw stronger rents and occupancy levels, the most since July 2015. Strong demand for apartments across the country continues to underpin the apartment industry’s strong fundamentals.”

…

The Market Tightness Index increased from 46 to 52, indicating overall improving conditions for the first time since October of 2015. Nearly one-third (30 percent) of respondents reported tighter market conditions in the three months prior compared to 25 percent who reported looser conditions. Almost half (45 percent) of respondents felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates market conditions were tighter over the last quarter.

This reading followed thirteen consecutive quarterly surveys indicating looser conditions.