by Calculated Risk on 5/14/2019 12:57:00 PM

Tuesday, May 14, 2019

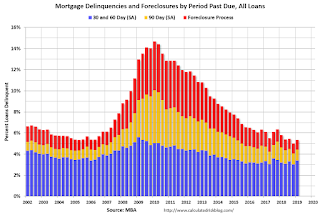

MBA: "Foreclosure inventory rate still at lowest level since 1995"

From the MBA: Mortgage Delinquencies Rise in the First Quarter of 2019

The delinquency rate for mortgage loans on one-to-four-unit residential properties rose to a seasonally adjusted rate of 4.42 percent of all loans outstanding at the end of the first quarter, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

Despite an uptick of 36 basis points on a quarterly basis, the delinquency rate was still down 21 basis points from one year ago. The percentage of loans on which foreclosure actions were started last quarter fell by 5 basis points from a year ago and 2 basis points from last quarter (to 0.23 percent).

“The national mortgage delinquency rate in the first quarter of 2019 was down on a year-over-year basis, which is another sign of a very strong economic environment, bolstered by low unemployment and rising wage growth,” said Marina Walsh, MBA’s Vice President of Industry Analysis. “Moreover, the serious delinquency rate – the percentage of loans that are 90 days or more past due or in the process of foreclosure – dropped across all loan types from the previous quarter and a year ago to its lowest overall level since the second quarter of 2006.”

Walsh noted that early 30-day delinquencies rose in the first quarter of 2019 on a seasonally-adjusted basis across all loan types. The rise in early delinquencies resulted in the overall mortgage delinquency rate climbing by 36 basis points. While higher than several quarters in 2017 and 2018, it is still the fourth lowest overall mortgage delinquency rate in the past 12 years.

...

By stage, the 30-day delinquency rate increased 29 basis points to 2.58 percent, the 60-day delinquency rate increased 7 basis points to 0.81 percent, and the 90-day delinquency bucket remained unchanged at 1.03 percent.

...

The delinquency rate includes loans that are at least one payment past due, but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 0.92 percent, down 3 basis points from the fourth quarter and 24 basis points lower than one year ago. This is the lowest foreclosure inventory rate since the fourth quarter of 1995.

...

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was at 1.96 percent – a decrease of 10 basis points from last quarter and a decrease of 65 basis points from last year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. There was a small increase in delinquencies in Q1, but the overall level is low.

The percent of loans in the foreclosure process continues to decline, and is now at the lowest level since 1995.