by Calculated Risk on 6/25/2019 11:29:00 AM

Tuesday, June 25, 2019

A few Comments on May New Home Sales

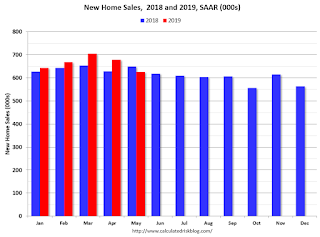

New home sales for May were reported at 626,000 on a seasonally adjusted annual rate basis (SAAR). Sales for April were revised up slightly, and sales for March were revised down.

Earlier: New Home Sales decreased to 626,000 Annual Rate in May.

This graph shows new home sales for 2018 and 2019 by month (Seasonally Adjusted Annual Rate).

Sales in May were down 3.7% year-over-year compared to May 2018.

Year-to-date (just through May), sales are up 4.0% compared to the same period in 2018.

This comparison was the most difficult in the first half of 2018, so even with the disappointing sales in May, this is a solid start for 2019.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

Even though distressed sales are down significantly, following the bust, new home builders focused on more expensive homes - so the gap has only closed slowly.

I still expect this gap to close. However, this assumes that the builders will offer some smaller, less expensive homes.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.