by Calculated Risk on 10/04/2019 09:07:00 AM

Friday, October 04, 2019

Comments on September Employment Report

The headline jobs number at 135 thousand for September ex-Census (136K total including temp Census hires) was below consensus expectations of 145 thousand, however the previous two months were revised up 45 thousand, combined. The unemployment rate declined to 3.5%; the lowest rate since 1969.

Earlier: September Employment Report: 136,000 Jobs Added, 3.5% Unemployment Rate

In September, the year-over-year employment change was 2.147 million jobs including Census hires (note: this will be revised down significantly in February with the benchmark revision).

Average Hourly Earnings

Wage growth was below expectations. From the BLS:

"In September, average hourly earnings for all employees on private nonfarm payrolls, at $28.09, were little changed (-1 cent), after rising by 11 cents in August. Over the past 12 months, average hourly earnings have increased by 2.9 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.9% YoY in September.

Wage growth had been generally trending up, but has weakened recently.

Prime (25 to 54 Years Old) Participation

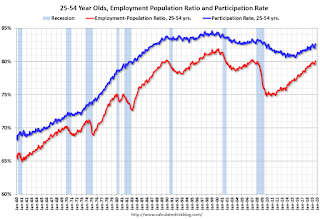

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in September at 82.6% from 82.6% in August, and the 25 to 54 employment population ratio was increased to 80.1% from 80.0%.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 4.4 million in September. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in September to 4.350 million from 4.381 million in August. The number of persons working part time for economic reason has been generally trending down.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 6.9% in September. This is the lowest level for U-6 since 2000.

Unemployed over 26 Weeks

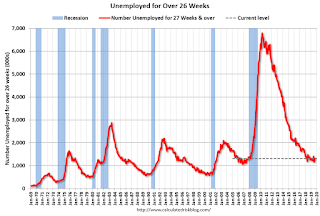

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.314 million workers who have been unemployed for more than 26 weeks and still want a job. This was up from 1.243 million in August.

Summary:

The headline jobs number was below expectations, however the previous two months were revised up. The headline unemployment rate declined to 3.5%; the lowest since 1969. However, wage growth was below expectations.

This was mixed jobs report.

The economy added 1.419 million jobs through September 2019 ex-Census, down from 1.979 million jobs during the same period of 2018 (although 2018 will be revised down with benchmark revision to be released in February 2020). So job growth has slowed.