by Calculated Risk on 10/23/2019 07:00:00 AM

Wednesday, October 23, 2019

MBA: Mortgage Applications Decreased in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 11.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 18, 2019.

... The Refinance Index decreased 17 percent from the previous week and was 126 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

“Interest rates continue to be volatile, with Brexit votes and ongoing trade negotiations swinging rates higher or lower on any given day. Last week, mortgage rates jumped 10 basis points and were above 4 percent for the first time since September,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “The increase in mortgage rates caused refinance applications to drop 17 percent, and by more than 20 percent for conventional loans. Borrowers with larger loans are the most sensitive to rate changes, and with rates climbing higher last week, the average size of a refinance loan application fell to its lowest level this year.”

Added Fratantoni, “Although purchase applications declined, application volume is still running about 6 percent ahead of this time last year. Low mortgage rates continue to fuel buyer interest, but supply and affordability challenges persist.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.02 percent from 3.92 percent, with points increasing to 0.38 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

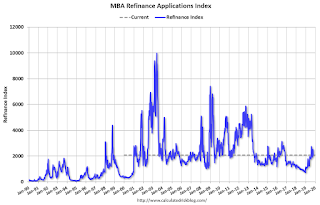

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity - but declined this week with higher rates. Mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 6% year-over-year.