by Calculated Risk on 10/09/2019 07:00:00 AM

Wednesday, October 09, 2019

MBA: Mortgage Applications Increased in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 4, 2019.

... The Refinance Index increased 10 percent from the previous week and was 163 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“U.S. Treasury rates moved sharply lower last week, as data showing weakness in the services sector was a sign that slowing economic growth is not confined to the manufacturing sector. This in turn caused a flight to safety by investors, resulting in mortgage rates dropping across the board, with the 30-year fixed rate decreasing nine basis points to 3.9 percent – the lowest level in a month,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “As seen a few times this year, the large drop in rates caused another surge in refinance applications. The refinance index increased 10 percent to its highest level since late August, with both conventional and government refinances experiencing an upswing.”

Added Kan, “Purchase activity was muted, declining almost 1 percent, but was still 10 percent higher than a year ago. Despite low rates, the cloudier economic outlook and ongoing market uncertainty may be keeping some potential homebuyers away from the market this fall.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.90 percent from 3.99 percent, with points decreasing to 0.37 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

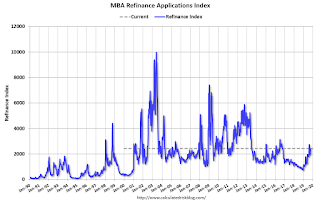

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity. Mortgage rates would have to decline further to see a huge refinance boom.

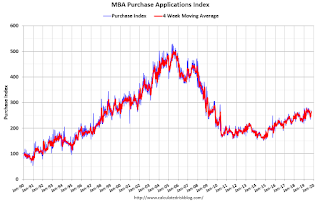

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.