by Calculated Risk on 2/25/2020 09:13:00 AM

Tuesday, February 25, 2020

Case-Shiller: National House Price Index increased 3.8% year-over-year in December

S&P/Case-Shiller released the monthly Home Price Indices for December ("December" is a 3 month average of October, November and December prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P CoreLogic Case-Shiller Index Shows Growth in Annual Home Price Gains to End 2019

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.8% annual gain in December, up from 3.5% in the previous month. The 10-City Composite annual increase came in at 2.4%, up from 2.0% in the previous month. The 20-City Composite posted a 2.9% year-over-year gain, up from 2.5% in the previous month.

Phoenix, Charlotte and Tampa reported the highest year-over-year gains among the 20 cities. In December, Phoenix led the way with a 6.5% year-over-year price increase, followed by Charlotte with a 5.3% increase and Tampa with a 5.2% increase. Twelve of the 20 cities reported greater price increases in the year ending December 2019 versus the year ending November 2019.

...

The National Index posted a month-over-month increase of 0.1%, while the 10-City Composite posted a 0.1% increase and the 20-City Composite did not post any gains before seasonal adjustment in December. After seasonal adjustment, the National Index posted a month-over-month increase of 0.5%, while the 10-City and 20-City Composites both posted 0.4% increases. In December, 10 of 20 cities reported increases before seasonal adjustment while 19 of 20 cities reported increases after seasonal adjustment.

"The U.S. housing market continued its trend of stable growth in December,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “December’s results bring the National Composite Index to a 3.8% increase for calendar 2019. This marks eight consecutive years of increasing housing prices (an increase which is echoed in our 10- and 20-City Composites). At the national level, home prices are 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak. Results for 2019 were broad-based, with gains in every city in our 20-City Composite.

emphasis added

Click on graph for larger image.

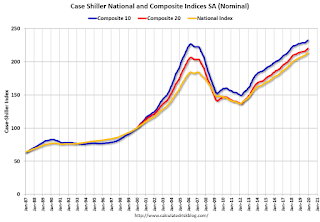

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 2.6% from the bubble peak, and up 0.4% in December (SA) from November.

The Composite 20 index is 6.5% above the bubble peak, and up 0.4% (SA) in December.

The National index is 15% above the bubble peak (SA), and up 0.5% (SA) in December. The National index is up 59% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 2.4% compared to December 2018. The Composite 20 SA is up 2.9% year-over-year.

The National index SA is up 3.5% year-over-year.

Note: According to the data, prices increased in 19 of 20 cities month-over-month seasonally adjusted.

I'll have more later.