by Calculated Risk on 3/04/2020 07:00:00 AM

Wednesday, March 04, 2020

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 15.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 28, 2020. The results for the week ending February 21, 2020, included an adjustment for the Presidents’ Day holiday.

... The Refinance Index increased 26 percent from the previous week and was 224 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“The 30-year fixed rate mortgage dropped to its lowest level in more than seven years last week, amidst increasing concerns regarding the economic impact from the spread of the coronavirus, as well as the tremendous financial market volatility. Refinance demand jumped as a result, with conventional refinance applications increasing more than 30 percent," said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Given the further drop in Treasury rates this week, we expect refinance activity will increase even more until fears subside and rates stabilize.”

Added Fratantoni, “We are now at the start of the spring homebuying season. While purchase applications were down a bit for the week, they are still up about 10 percent from a year ago. The next few weeks are key in whether these low mortgage rates bring in more buyers, or if economic uncertainty causes some home shoppers to temporarily delay their search.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.57 percent from 3.73 percent, with points decreasing to 0.26 from 0.27 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

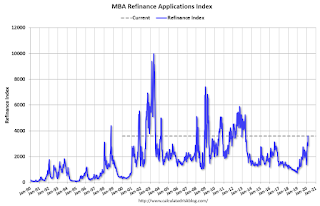

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, and with the further decline in rates this week, we will probably see a huge increase in refinance activity in the survey next week.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.

As Fratantoni noted, a key question is will low mortgage rates bring in more buyers, or will people hold off buying a home during the health crisis (as happened in China).