by Calculated Risk on 4/22/2020 08:51:00 AM

Wednesday, April 22, 2020

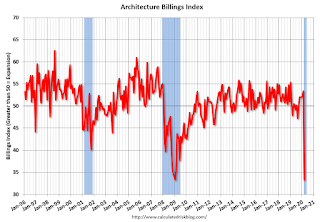

AIA: Architecture Billings Index Decreased Sharply in March

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index points to major downturn in commercial construction

Reflecting the deteriorating conditions in the overall economy, demand for design services from architecture firms recorded a record fall, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 33.3 for March reflects a decrease in design services provided by U.S. architecture firms (any score below 50 indicates a decrease in billings). During March, both the new project inquiries and design contracts scores dropped dramatically, posting scores of 23.8 and 27.1 respectively.

“Though most architecture firms have made quick transitions to remote operations, the complete shutdown of business activity is severely impacting architects,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The dramatic pullback in new and ongoing design projects reflects just how quickly and fundamentally business conditions have changed across the country and around the world in the last month as a result of the COVID-19 pandemic.”

...

• Regional averages: West (45.3); South (44.2); Midwest (44.2); Northeast (38.4)

• Sector index breakdown: institutional (46.9); multi-family residential (43.3); commercial/industrial (41.9); mixed practice (40.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 33.3 in March, down from 53.4 in February. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This was the largest one month decline on record for this index. This also matches the lowest level for this index during the Great Recession.