by Calculated Risk on 4/10/2020 11:10:00 AM

Friday, April 10, 2020

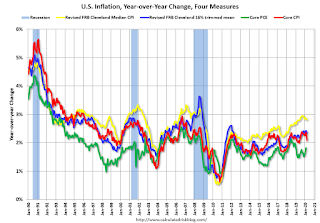

Cleveland Fed: Key Measures Show Inflation Near 2% YoY in March

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.5% annualized rate) in March. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for March here. Motor fuel decreased at a 73% annualized rate in March!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.4% (-5.0% annualized rate) in March. The CPI less food and energy fell 0.1% (-1.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.1%. Core PCE is for February and increased 1.8% year-over-year.

On a monthly basis, median CPI was at 2.5% annualized and trimmed-mean CPI was at 1.9% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%). Inflation will not be a concern during the crisis.