by Calculated Risk on 4/27/2020 04:00:00 PM

Monday, April 27, 2020

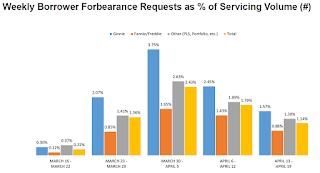

MBA Survey: "Share of Mortgage Loans in Forbearance Increases to 6.99%" of Portfolio Volume

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Increases to 6.99%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased from 5.95% of servicers’ portfolio volume in the prior week to 6.99% as of April 19, 2020.

“Over 26 million Americans have filed for unemployment over the last month, leading to nearly 7 percent – 3.5 million – of all mortgage borrowers asking to be put into forbearance plans. For FHA and VA borrowers, the share of loans in forbearance is even higher, at 10 percent,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Forbearance requests fell relative to the prior week but remain roughly 100 times greater than the early March baseline. While the pace of job losses have slowed from the astronomical heights of just a few weeks ago, millions of people continue to file for unemployment. We expect forbearance requests will pick up again as we approach May payment due dates.”

Added Fratantoni, “The combination of stimulus payments, expanded unemployment insurance benefits, further fiscal and monetary actions, and states reopening will hopefully begin to stabilize forbearance requests and the overall economy.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly forbearance requests as a percent of servicer's portfolio volume.

The requests peaked in the week of March 30th to April 5th, but might pick up again when May payments are due.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) dropped relative to the prior week: from 1.79% to 1.14%."