by Calculated Risk on 4/30/2020 10:26:00 AM

Thursday, April 30, 2020

Q1 2020 GDP Details on Residential and Commercial Real Estate

The BEA has released the underlying details for the Q1 initial GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 9.7% annual pace in Q1.

Investment in petroleum and natural gas exploration decreased in Q1 compared to Q4, and was down 24% year-over-year. This will probably collapse in Q2.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices decreased in Q1, but was only down slightly year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 27% year-over-year in Q1 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q1, and lodging investment was down 8% year-over-year.

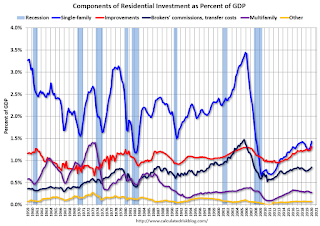

Usually single family investment is the top category, although home improvement was the top category for five consecutive years following the housing bust. Then investment in single family structures was back on top, however it is close between single family and home improvement.

Even though investment in single family structures has increased from the bottom, single family investment is still low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases - once the healthcare crisis abates.

Investment in single family structures was $308 billion (SAAR) (about 1.4% of GDP)..

Investment in multi-family structures decreased in Q1.

Investment in home improvement was at a $283 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.3% of GDP). Home improvement spending has been solid and might hold up during the pandemic.