by Calculated Risk on 5/11/2020 04:01:00 PM

Monday, May 11, 2020

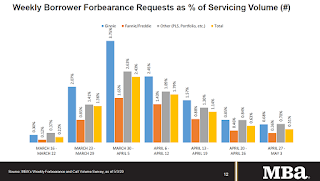

MBA Survey: "Share of Mortgage Loans in Forbearance Increases to 7.91%" of Portfolio Volume

Note: To put these numbers in perspective, the MBA notes "For the week of March 2, only 0.25% of all loans were in forbearance."

From the MBA: Share of Mortgage Loans in Forbearance Increases to 7.91%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance increased from 7.54% of servicers’ portfolio volume in the prior week to 7.91% as of May 3, 2020. According to MBA’s estimate, almost 4 million homeowners are now in forbearance plans.

...

“With the calendar turning to May, the share of loans in forbearance increased, but the pace of the increase and incoming forbearance requests continued to slow,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The dreadful April jobs report showed a decline of more than 20 million jobs, and a spike in the unemployment rate to the highest level since the Great Depression. It will not be surprising if the forbearance numbers continue to rise. As we anticipated, FHA and VA borrowers have been most impacted by the job losses thus far, with the share of Ginnie Mae loans in forbearance at almost 11 percent.”

Added Fratantoni, “Although the pace of forbearance requests slowed this week, call volume picked up – which could be a sign that more borrowers are calling in to check their options now that May due dates have arrived.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly forbearance requests as a percent of servicer's portfolio volume.

The requests peaked in the week of March 30th to April 5th, but might pick up again.

The MBA notes: "Forbearance requests as a percent of servicing portfolio volume (#) dropped across all investor types for the fourth consecutive week relative to the prior week: from 0.63% to 0.51%."