by Calculated Risk on 5/18/2020 08:16:00 AM

Monday, May 18, 2020

Six High Frequency Indicators for the Eventual Recovery

These indicators are for travel and entertainment - some of the sectors that will probably recover very slowly.

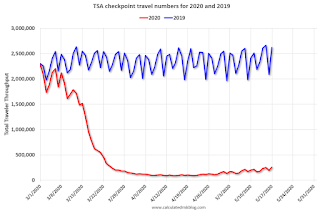

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On May 17th there were 253,807 travelers compared to 2,620,276 a year ago.

That is a decline of 90.3%. There has been some increase off the bottom, but it is pretty small compared to the normal level of travel.

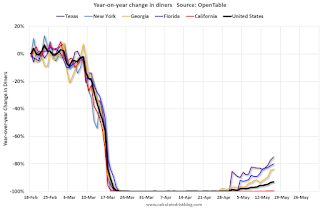

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through May 16, 2020.

The US was off 100% YoY as of March 21st.

California and New York are still off 100%.

Some states - like Texas and Georgia - have started to open up. In Texas, diner traffic was only down 75% YoY.

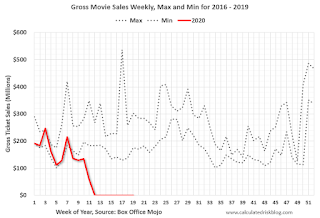

Note that the data is noisy and depends on when blockbusters are released.

Movie ticket sales have been essentially at zero for eight weeks.

Basically movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change. I added 2001 to show the impact on hotel occupancy after 9/11.

STR reported hotel occupancy was off 55.9% year-over-year last week. Occupancy has increased slightly over the last few of weeks.

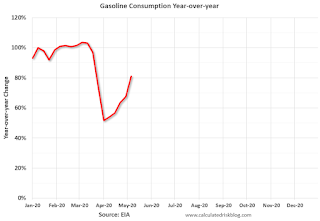

At one point, gasoline consumption was off almost 50% YoY.

As of May 8th, gasoline consumption was off about 20% YoY (about 80% of normal).

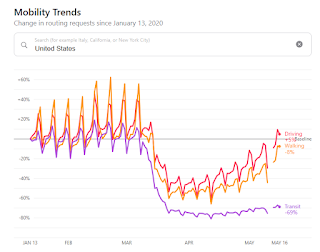

The final graph is from Apple mobility.

According to the Apple data, driving is back to normal, walking is a somewhat below normal, but public transit is still off 69% from the pre-crisis level.