by Calculated Risk on 6/01/2020 08:26:00 AM

Monday, June 01, 2020

Six High Frequency Indicators for the Eventual Recovery

These indicators are mostly for travel and entertainment - some of the sectors that will probably recover very slowly.

The TSA is providing daily travel numbers.

This data shows the daily total traveler throughput from the TSA for 2019 (Blue) and 2020 (Red).

On May 30th there were 268,867 travelers compared to 2,117,180 a year ago.

That is a decline of 87.3%. There has been some increase off the bottom, but it is pretty small compared to the normal level of travel.

The second graph shows the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

This data is updated through May 30, 2020.

The US was off 100% YoY as of March 21st.

New York is still off 100%.

Some states - like Texas and Georgia - are only down 55% YoY.

Note that the data is noisy and depends on when blockbusters are released.

Movie ticket sales have picked up slightly, but have been essentially at zero for ten weeks.

Most movie theaters are closed all across the country, and will probably reopen slowly (probably with limited seating at first).

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

2020 was off to a solid start, however, COVID-19 has crushed hotel occupancy.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

STR reported hotel occupancy was off 50.2% year-over-year last week. Occupancy has increased slightly over the last few of weeks.

At one point, gasoline consumption was off almost 50% YoY.

As of May 22nd, gasoline consumption was off about 23% YoY (about 77% of normal).

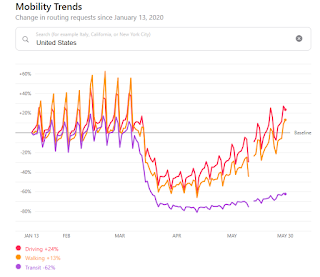

The final graph is from Apple mobility.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so this means walking in driving is back to winter levels!

According to the Apple data, walking and driving are above January levels, but public transit is still off 62% from the January level.