by Calculated Risk on 10/07/2020 07:00:00 AM

Wednesday, October 07, 2020

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 2, 2020.

... The Refinance Index increased 8 percent from the previous week and was 50 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 21 percent higher than the same week one year ago.

“Mortgage rates declined across the board last week – with most falling to record lows – and borrowers responded. The refinance index jumped 8 percent and hit its highest level since mid-August,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Continuing the trend seen in recent months, the purchase market is growing at a strong clip, with activity last week up 21 percent from a year ago. The average loan size increased again to a new record at $371,500, as activity in the higher loan size categories continues to lead growth.”

Added Kan, “There are signs that demand is waning at the entry-level portion of the market because of supply and affordability hurdles, as well as the adverse economic impact the pandemic is having on hourly workers and low-and moderate-income households. As a result, the lower price tiers are seeing slower growth, which is contributing to the rising trend in average loan balances.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.01 percent from 3.05 percent, with points decreasing to 0.37 from 0.52 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

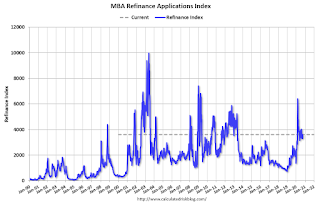

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 21% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).