The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

Of course - with the sudden economic stop due to COVID-19 - the usual pattern doesn't apply.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.Residential investment (RI) increased at a 59.3% annual rate in Q3. Equipment investment increased at a 70.1% annual rate, and investment in non-residential structures decreased at a 14.6% annual rate.

The contribution to Q3 GDP from investment in private inventories was 6.6 percentage points.

On a 3 quarter trailing average basis, RI (red) is up solidly, equipment (green) is up, and nonresidential structures (blue) is down sharply.

On a 3 quarter trailing average basis, RI (red) is up solidly, equipment (green) is up, and nonresidential structures (blue) is down sharply.

I'll post more on the components of non-residential investment once the

supplemental data is released.

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP increased in Q3. RI as a percent of GDP is still close to previous lows, and I expected RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

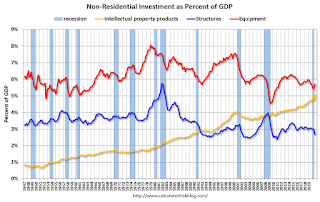

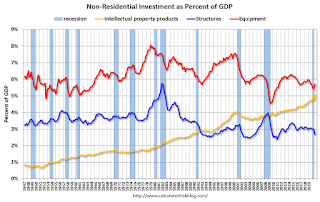

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The second graph shows residential investment as a percent of GDP.

The second graph shows residential investment as a percent of GDP.Residential Investment as a percent of GDP increased in Q3. RI as a percent of GDP is still close to previous lows, and I expected RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

The third graph shows non-residential investment in

structures, equipment and "intellectual property products".

Investment in non-residential structures declined in Q3, and will probably be weak for some time (hotel occupancy is low, office and mall vacancy rates are rising).