by Calculated Risk on 11/10/2020 10:21:00 AM

Tuesday, November 10, 2020

MBA: "Mortgage Delinquencies Decrease in the Third Quarter of 2020"

From the MBA: Mortgage Delinquencies Decrease in the Third Quarter of 2020

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 7.65 percent of all loans outstanding at the end of the third quarter of 2020, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 57 basis points from the second quarter of 2020 and up 368 basis points from one year ago. For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

“Consistent with the improving labor market and the overall economic rebound, homeowners’ ability to make their mortgage payments improved in the third quarter,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The decrease in the mortgage delinquency rate was driven by a sharp decline in newer 30-day delinquencies and 60-day delinquencies. Particularly encouraging was the 30-day delinquency rate, which reached its lowest level since MBA’s survey began in 1979.”

Added Walsh, “Nonetheless, the 90-day and over delinquency rate continued to grow and reached its highest level since the second quarter of 2010. With forbearance plans still active and foreclosure moratoriums in place until at least the end of the year, many borrowers experiencing longer-term distress will remain in this delinquency category until a loss mitigation resolution is available.”

emphasis added

Click on graph for larger image.

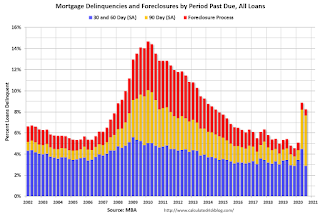

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due. Overall delinquencies decreased in Q3.

The decrease was in the 30 day and 60 and day buckets.

From the MBA: "Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 48 basis points to 1.86 percent, the lowest rate since the survey began in 1979. The 60-day delinquency rate decreased 113 basis points to 1.02 percent, and the 90-day delinquency bucket increased 106 basis points to 4.78 percent, the highest rate since the second quarter of 2010."

This sharp increase in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The percent of loans in the foreclosure process declined further, and was at the lowest level since 1982.

This sharp increase in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The percent of loans in the foreclosure process declined further, and was at the lowest level since 1982.