by Calculated Risk on 12/03/2020 12:15:00 PM

Thursday, December 03, 2020

November Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for November. The consensus is for 500 thousand jobs added, and for the unemployment rate to decrease to 6.7%.

First, there are a wide range of estimates. For example, from Merrill Lynch economists:

"We look for November jobs report to show nonfarm payroll growth pulled back to 150k following a gain of 638k in October. Private payrolls should add 300k. Lackluster job growth should keep the U-rate unchanged at 6.9%, breaking a 6-mo streak of declines."• Decennial Census: The decennial Census will subtract 93,026 temporary government jobs.

• ADP Report: The ADP employment report showed a gain of 307,000 private sector jobs, below the consensus estimate of 420 thousand jobs. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be weaker than expected.

• ISM Surveys: The ISM manufacturing employment index decreased in November to 48.4%, down from 53.2% in October. This would suggest essentially approximately 30,000 manufacturing jobs lost in November - although ADP showed 8,000 manufacturing jobs added.

The ISM Services employment index increased in November for 51.5% from 50.1% October, and is just above 50. This would suggest around 125,000 service jobs added in November. Combined, the ISM surveys suggest around 75,000 private sector jobs added in November. The ISM surveys haven't been as useful as usual during the pandemic, but this does suggest the report could be weaker than expected.

• Unemployment Claims: The weekly claims report showed a high number of total continuing unemployment claims during the reference week, although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession!

• Homebase, Kronos/UKG: There are other indicators that analysts are looking at - like Homebase hours worked and Kronos (see Ernie Tedeschi comments):

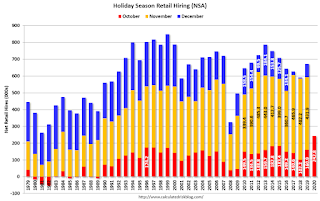

"A slew of recent data is consistent with slow or even negative jobs growth in November. A quick thread."• Seasonal Retail Hiring: Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Click on graph for larger image.

Click on graph for larger image.In 2019, retailers hired 432,000 seasonal employees (NSA) in November. That translated to a loss of 14,000 SA. Brick and Mortar retailers could be more cautious this year, and retail might decline SA in November.

With the larger than expected increase in retail hiring in October (NSA), and the ongoing pandemic, this could negatively impact the November report.

This will be something to watch.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers have been increasing (small decrease in October).

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers have been increasing (small decrease in October).

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the October report.

This data is only available back to 1994, so there is only data for three recessions. In October, the number of permanent job losers decreased to 3.684 million from 3.756 million in September.

• Conclusion: The employment related data has been all over the place, but most of the indicators suggest a weaker report in November than October. My guess is the report will be lower than the consensus.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers have been increasing (small decrease in October).

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers have been increasing (small decrease in October).This graph shows permanent job losers as a percent of the pre-recession peak in employment through the October report.

This data is only available back to 1994, so there is only data for three recessions. In October, the number of permanent job losers decreased to 3.684 million from 3.756 million in September.

• Conclusion: The employment related data has been all over the place, but most of the indicators suggest a weaker report in November than October. My guess is the report will be lower than the consensus.