by Calculated Risk on 12/20/2020 01:10:00 PM

Sunday, December 20, 2020

Some thoughts on Housing Inventory

Last week I posted some 2021 housing forecasts. I noted:

There are a wide range of estimates, especially on house prices in 2021, with price forecasts ranging from increases of 2% to 10%. These forecasts use different measures, but that is a very wide spread.So what will happen with inventory in 2021?

The key in 2021 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation.

Click on graph for larger image.

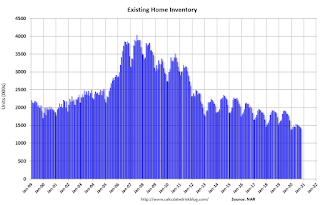

Click on graph for larger image.This graph, based on data from the National Association of Realtors® (NAR), shows nationwide inventory for existing homes.

According to the NAR, inventory was at 1.42 million in October. This was the lowest level on record for the month of October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

Inventory had steadily decreased following the housing bust, and seemed to mostly level out in 2017 through 2019. Then inventory really declined in 2020.

Prior to 2020, two of the key reasons inventory was low:

1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors. Most of these rental conversions were at the lower end, and that limited the supply for first time buyers.

2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80). The leading edge of the boomers are now turning 76 or so, and the boomers selling will probably gradually increase over the next 10 years.

In 2020, inventory really declined due to a combination of potential sellers keeping their properties off the market during a pandemic, and a pickup in buying due to record low mortgage rates, a move away from multi-family rentals and strong second home buying (to escape the high-density cities).

And at the same time, demographics are now favorable for home buying.

NOTE: This graph is updated using the Vintage 2019 estimates. IMPORTANT NOTE: Housing economist Tom Lawler has pointed out some issues with Census estimates, see: Lawler: The Dismal Demographics of 2020

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).

This graph shows the longer term trend for three key age groups: 20 to 29, 25 to 34, and 30 to 39 (the groups overlap).This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group peaked in 2018 / 2019 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak around 2023. This suggests demand for apartments will soften somewhat.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next decade.

This demographics is now positive for home buying, and this is a key reason I expected the increase in single family housing starts in 2020.

Note: Based on Lawler's work, I expect some downward revisions to the prime population following the 2020 Census (lower immigration, more prime age deaths). But the general story will remain the same.

So what does this mean for inventory in 2021?

First, making the assumption that the pandemic will be mostly over by mid-2021, we can make a few general predictions:

1. Potential sellers will be more willing to list their homes (and allow strangers into their homes).

2. The move away from dense cities will slow and maybe end. What makes cities attractive (jobs, cultural events and other entertainment), hasn't been available during the pandemic. That will change when the pandemic ends, and cities will be attractive again. Of course, the trends toward remote working, online shopping and home entertainment will likely continue, and this will allow some people to live anywhere.

3. Demographics will be favorable for home buying. The generation moving into the home buying years is much larger than the leading edge of the boomers that will be downsizing - or moving into retirement communities.

4. Mortgage rates are probably close to a bottom now, but it seems unlikely rates will increase quickly with the Fed will be holding down rates for the foreseeable future.

5. Homebuilders will continue to respond to low inventories, and housing starts will likely increase further in 2021.

The bottom line is inventory will probably increase, especially in the 2nd half of 2021 (with the assumption that the pandemic will be mostly over by mid-year). I'll have more on this when I post my predictions for next year.