by Calculated Risk on 4/01/2021 12:46:00 PM

Thursday, April 01, 2021

March Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for March. The consensus is for 565 thousand jobs added, and for the unemployment rate to decrease to 6.0%.

Some analysts think this will be a very strong report with maybe 1 million jobs added. For example, from Merrill Lynch economists:

"We look for nonfarm payrolls to grow by a robust 1mn in March following a gain of 379k in February. Labor market indicators undoubtedly showed strong employment activity over the month. ... The unemployment rate should drop to 5.9% from 6.2% reflecting the strong job gains."

• First, currently there are still about 9.5 million fewer jobs than in February 2020 (before the pandemic).

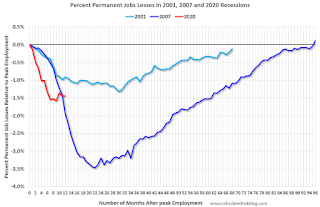

• First, currently there are still about 9.5 million fewer jobs than in February 2020 (before the pandemic).This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession is by far the worst recession since WWII in percentage terms, and is currently about as bad as the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 517,000 private sector jobs, below the consensus estimate of 550 thousand jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be close to expectations.

• ISM Surveys: The ISM® manufacturing employment index increased in March to 59.6%, up from 54.4% last month. This would suggest essentially approximately 35,000 manufacturing jobs added in March. ADP showed 49,000 manufacturing jobs added.

The ISM® Services employment index will be released next week.

• Unemployment Claims: The weekly claims report showed a high number of initial unemployment claims during the reference week (include the 12th of the month), although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd think the economy was in a deep recession! In general, weekly claims have been close to expectations.

• Weather: Weather is a wildcard every year during the winter. The SF Fed estimated that weather reduced employment by about 100 thousand in February. Usually we'd expect a bounce back in March, so this should provide a boost to the March report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report.

This data is only available back to 1994, so there is only data for three recessions. In February, the number of permanent job losers was mostly unchanged at 3.497 million from 3.503 million in January.

• Conclusion: Most of the indicators suggest a strong report in March. My guess is the report will be above the consensus.