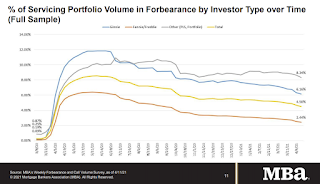

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 4.50%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 16 basis points from 4.66% of servicers’ portfolio volume in the prior week to 4.50% as of April 11, 2021. According to MBA’s estimate, 2.3 million homeowners are in forbearance plans.

...

“The share of loans in forbearance decreased for the seventh straight week and has now dropped 40 basis points in the last two weeks. The forbearance share decreased for all three investor categories, with the rate for portfolio and PLS loans decreasing by 31 basis points this past week – the largest drop across investor categories,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Forbearance exits increased for portfolio and PLS loans but decreased for GSE and Ginnie Mae loans. More than 36 percent of borrowers in forbearance extensions have now exceeded the 12-month mark.”

Fratantoni added, “Economic data on home construction and consumer spending in March show a strong housing market and a quickened pace of economic activity. Combined with the homeowner assistance and stimulus payments that many households are receiving, we expect that the forbearance numbers will continue to decline in the months ahead as more individuals regain employment. Homeowners who are still facing hardships and need to extend their forbearance term should contact their servicers.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has trended down since then.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained flat relative to the prior week at 0.05%."