by Calculated Risk on 5/06/2021 12:31:00 PM

Thursday, May 06, 2021

April Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus is for 978 thousand jobs added, and for the unemployment rate to decrease to 5.7%.

Some analysts think this will be a very strong report with maybe 1.5 to 2.1 million jobs added.

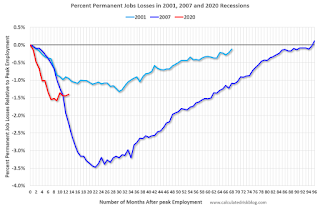

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, and is now slightly better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 742,000 private sector jobs, below the consensus estimate of 830,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be close to expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in April to 55.1%, down from 59.6% last month. This would suggest approximately 10,000 manufacturing jobs added in April. ADP showed 55,000 manufacturing jobs added.

The ISM® Services employment index increased in April to 58.8%, up from 57.7% last month. This would suggest over 300,000 service jobs added in April. ADP showed 636,000 service jobs added.

• Unemployment Claims: The weekly claims report showed a sharp decline in the number of initial unemployment claims during the reference week (include the 12th of the month) from 765,000 in March to 566,000 in April. This would usually suggest a pickup in hiring, although this might not be very useful right now. If we did a "Rip Van Winkle", and saw the weekly claims report this morning, we'd still think the economy was in a deep recession! In general, weekly claims have been lower than expectations.

• Weather: The SF Fed estimated that weather boosted employment by about 100 thousand in March, after reducing employment by 100 thousand in February. Weather is probably not a factor for April, but when we compare to March, we have to remember employment was boosted by weather last month.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the December report.

This data is only available back to 1994, so there is only data for three recessions. n March, the number of permanent job losers decreased slightly to 3.432 million from 3.497 million in February.

• Conclusion: Most of the indicators suggest another strong report in April and many analysts are upgrading their forecasts to over 1 million jobs added. However, my guess is the report will be at or below the consensus.