by Calculated Risk on 6/09/2021 07:00:00 AM

Wednesday, June 09, 2021

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 4, 2021. This week’s results include an adjustment for the Memorial Day holiday.

... The Refinance Index decreased 5 percent from the previous week and was 27 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier. The unadjusted Purchase Index decreased 11 percent compared with the previous week and was 24 percent lower than the same week one year ago.

“Most of the decline in mortgage rates came late last week, with the 30-year fixed-rate mortgage declining to 3.15 percent. This likely impacted refinance applications, which fell 5 percent for both conventional and government loans. With fewer homeowners able to take advantage of lower rates, the refinance share dipped to the lowest level since April,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications were up slightly last week, and the large annual decline was the result of Memorial Day 2021 being compared to a non-holiday week, as well as the big upswing in applications seen last May once pandemic-induced lockdowns started to lift.”

Added Kan, “The average loan size on a purchase application edged down to $407,000, below the record $418,000 set in February, but still far above 2020’s average of $353,900. Home-price growth continues to accelerate, driven by favorable demographics, the recovering job market and economy, and housing demand far outpacing supply.”

...

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) decreased to 3.29 percent from 3.34 percent, with points decreasing to 0.32 from 0.38 (including the origination fee) for 80 percent LTV loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With low rates, the index remains elevated, but this is the lowest level since February 2020 (pre-pandemic).

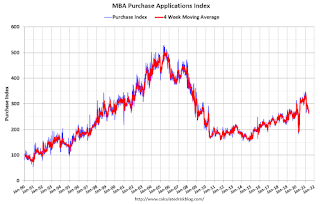

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 24% year-over-year unadjusted.

According to the MBA, purchase activity is down 24% year-over-year unadjusted.Note: The year ago comparisons for the unadjusted purchase index are now more difficult since purchase activity picked up in late May 2020. This week, the unadjusted comparison is especially ugly (holiday week this year vs non-holiday week last year).

Note: Red is a four-week average (blue is weekly).