by Calculated Risk on 10/25/2021 01:34:00 PM

Monday, October 25, 2021

Housing and Recessions

One of my favorite models for business cycle forecasting uses new home sales (also housing starts and residential investment). I also look at the yield curve, but I've found new home sales is generally more useful. (See my post in 2019: Don't Freak Out about the Yield Curve)

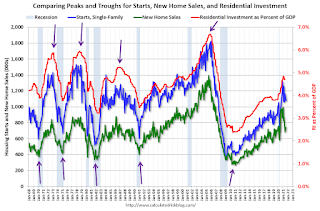

For the economy, what I focus on is single family starts and new home sales. For the bottoms and troughs for key housing activity, here is a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

Note: The pandemic has distorted the economic data, and - as I've noted many times - we can't be a slave to any model.

Click on graph for larger image.

Click on graph for larger image.The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

New home sales and single family starts have turned down recently, but this is because of the huge surge in sales and starts in the 2nd half of 2020.

The second graph shows the YoY change in New Home Sales from the Census Bureau.

The second graph shows the YoY change in New Home Sales from the Census Bureau.Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

Some observations:

1) When the YoY change in New Home Sales falls about 20%, usually a recession will follow. An exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession. Another exception is the current situation - due to the pandemic and the pickup in new home sales in the second half of 2020.

Also note that the sharp decline in 2010 was related to the housing tax credit policy in 2009 - and was just a continuation of the housing bust.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

Although new home sales are currently down over 20% year-over-year, this is just due to the delayed sales in 2020, and is not an indicator of an impending recession. No worries.

2) It is also interesting to look at the '86/'87 and the mid '90s periods. New Home sales fell in both of these periods, although not quite 20%. As I noted in earlier posts, the mid '80s saw a surge in defense spending and MEW that more than offset the decline in New Home sales. In the mid '90s, nonresidential investment remained strong.

Although new home sales are currently down over 20% year-over-year, this is just due to the delayed sales in 2020, and is not an indicator of an impending recession. No worries.