by Calculated Risk on 10/10/2021 08:11:00 AM

Sunday, October 10, 2021

Reis: Office and Mall Vacancy Rates Decreased Slightly in Q3

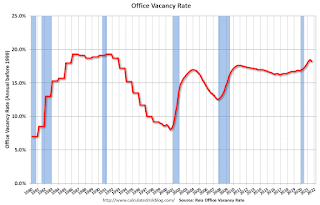

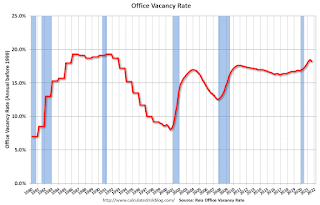

Reis reported the office vacancy rate was at 18.2% in Q3, down from 18.5% in Q2, and up from 17.4% in Q3 2020.

The previous quarter (back in Q2) saw the highest vacancy rate for offices since the early '90s (following the S&L crisis).

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis also reported that office effective rents increased slightly in Q3; this followed five consecutive quarter with declining rents.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

The office vacancy rate was elevated prior to the pandemic, and moved up during the pandemic.

Reis also reported that office effective rents increased slightly in Q3; this followed five consecutive quarter with declining rents.

The second graph shows the regional and strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual).

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.4% in Q3, down from 10.5% in Q2, and unchanged from 10.4% in Q3 2020.

For Regional malls, the vacancy rate was 11.2% in Q3, down from 11.5% in Q2, and up from 10.1% in Q3 2020.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.4% in Q3, down from 10.5% in Q2, and unchanged from 10.4% in Q3 2020.

For Regional malls, the vacancy rate was 11.2% in Q3, down from 11.5% in Q2, and up from 10.1% in Q3 2020.

Reis reported that mall effective rents increased slightly in Q3, after stabilizing in Q2. This followed five consecutive quarters will declining rents.

All vacancy data courtesy of Reis

All vacancy data courtesy of Reis