by Calculated Risk on 11/18/2021 03:17:00 PM

Thursday, November 18, 2021

Lawler: Investors, Second Homes, and AMH, oh my!

From housing economist Tom Lawler:

Investor Share of Home Purchases Surges

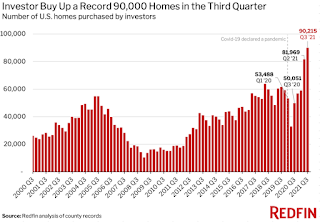

Recent reports from Redfin and Corelogic indicate that the investor share of home purchases has surged this year.

Here is a chart from a Redfin report released on November 15th.

Redfin identified an “investor” as follows:

We define an investor as any buyer whose name includes at least one of the following keywords: LLC, Inc, Trust, Corp, Homes. We also define an investor as any buyer whose ownership code on a purchasing deed includes at least one of the following keywords: association, corporate trustee, company, joint venture, corporate trust. This data may include purchases made through family trusts for personal use.Using this methodology, Redfin would probably miss small, “mom and pop” investors.

Redfin also noted that the share of investor purchases that were single-family homes hit a record high last quarter, and that lower-priced homes made up a significantly lower share of investor purchases than in previous quarters.

In a report released October 6th, Corelogic issued a report showing that the investor share of home purchases surged to a record high in the second quarter of the year (their data only go through June).

Here are the data from a chart in their report.

CoreLogic’s share of investor purchases is larger than Redfin’s, apparently because their methodology identifies smaller investors while Redfin’s does not.

CoreLogic’s share of investor purchases is larger than Redfin’s, apparently because their methodology identifies smaller investors while Redfin’s does not.CoreLogic also noted that there has been an especially large increase in “large” investor purchases, and that investors purchases of higher priced homes had increased significantly.

These data seem to confirm anecdotal reports of huge investments in private equity and other institutional investors in the single-family rental market this year.

What is interesting, and perhaps a bit disturbing, about these data is that the surge in investor buying happened (1) AFTER home prices had surged; and (2) at a time when the inventory of homes for sale was exceptionally low.

Second Home Buying Off from Post-Pandemic High But Still Way Above Pre-Pandemic Levels

In a recently-released report, Redfin using analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue, said that “(d)emand for second homes was up 70% from pre-pandemic levels in October, outpacing August’s 48% gain but below January’s record 91% growth.”

Here is a chart from that report.

Note that this “demand index” is based on mortgage rate-lock data. Since the share of second home purchases that are cash-financed is typically fairly high, the index may not fully reflect trends in second home purchases.

Note that this “demand index” is based on mortgage rate-lock data. Since the share of second home purchases that are cash-financed is typically fairly high, the index may not fully reflect trends in second home purchases.I’ll have more on these topics later. However these data suggest that the astonishingly strong rebound in the housing market following the onset of the pandemic is not solely due to, and perhaps not much related to, “demographics.”

American Home 4 Rent (ticker AMH) Strategic Strategy: Grow, Grow, Grow (from a November Investor Presentation)

American Homes 4 Rent, one of the largest publicly-traded companies in the single-family rental market that has embarked on an aggressive “build-to-rent” program, included the following data in its November “Investor Highlights” report.

| 2018 | 2019 | 2020 | 2021(3) | |

|---|---|---|---|---|

| Total | 2,351 | 1,379 | 2,592 | 4,650 |

| National Builders | 408 | 148 | 381 | 350 |

| Traditional Acquisitions | 1,552 | 286 | 564 | 2,250 |

| AMH Development | 391 | 945 | 1,647 | 2,050 |

| AMH Land Development Pipeline (Lots Owned or Controlled) | |

|---|---|

| 2016 | 217 |

| 2017 | 2,046 |

| 2018 | 4,203 |

| 2019 | 6,377 |

| 2020 | 8,954 |

| 2021(e) | 16,000 |