by Calculated Risk on 11/17/2021 07:00:00 AM

Wednesday, November 17, 2021

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 12, 2021.

... The Refinance Index decreased 5 percent from the previous week and was 31 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 6 percent lower than the same week one year ago.

“Refinance applications decreased for the seventh time in eight weeks, as mortgage rates moved higher after two weeks of declines. Activity has been particularly sensitive to rate movements, and last week’s decline was driven by a drop in conventional and FHA refinance applications, which offset an increase in VA refinance applications. All mortgage rates in MBA’s survey increased, with the 30-year fixed rate climbing to 3.2 percent.” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase applications increased for both conventional and government loan segments, as housing demand continues to show resiliency at a time – late fall – when home buying activity typically slows. The second straight increase in purchase applications suggests that stronger sales activity may continue in the weeks to come. Despite elevated demand, purchase applications were 5.7 percent lower than a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.20 percent from 3.16 percent, with points increasing to 0.43 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains somewhat elevated.

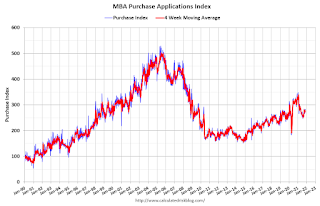

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 6% year-over-year unadjusted.

According to the MBA, purchase activity is down 6% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).