by Calculated Risk on 11/01/2021 04:00:00 PM

Monday, November 01, 2021

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 2.15%"

Note: This is as of October 24th.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 2.15%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 2.21% of servicers’ portfolio volume in the prior week to 2.15% as of October 24, 2021. According to MBA’s estimate, 1.1 million homeowners are in forbearance plans.

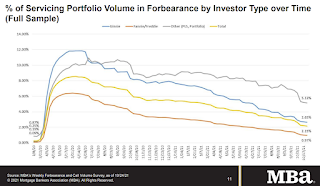

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 3 basis points to 0.97%. Ginnie Mae loans in forbearance decreased 7 basis points to 2.65%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 8 basis points to 5.13%. The percentage of loans in forbearance for independent mortgage bank (IMB) servicers decreased 6 basis points relative to the prior week to 2.43%, and the percentage of loans in forbearance for depository servicers decreased 4 basis points to 2.07%.

“For the first time since March 2020, the share of Fannie Mae and Freddie Mac loans in forbearance dropped below 1 percent. A small decline for this investor category was matched by similarly small declines for Ginnie Mae and portfolio/PLS loans,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Forbearance exits slowed at the end of October to the slowest pace since late August. With so many borrowers having reached the end of their 18-month forbearance term, we expect a steady pace of exits in November.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. The number of forbearance plans is decreasing rapidly recently since many homeowners have reached the end of the 18-month term.

Some stats on exits:

Of the cumulative forbearance exits for the period from June 1, 2020, through October 24, 2021, at the time of forbearance exit:

• 29.1% resulted in a loan deferral/partial claim.

• 20.6% represented borrowers who continued to make their monthly payments during their forbearance period.

• 16.7% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

• 13.1% resulted in a loan modification or trial loan modification.

• 12.0% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

• 7.1% resulted in loans paid off through either a refinance or by selling the home.

• The remaining 1.4% resulted in repayment plans, short sales, deed-in-lieus or other reasons.