by Calculated Risk on 11/21/2021 11:44:00 AM

Sunday, November 21, 2021

Recession Measures and NBER

Calling the beginning or end of a recession usually takes time. However, the economic decline in March 2020 was so severe that the National Bureau of Economic Research (NBER) quickly called the end of the expansion in February.

The committee has determined that a peak in monthly economic activity occurred in the U.S. economy in February 2020. The peak marks the end of the expansion that began in June 2009 and the beginning of a recession. The expansion lasted 128 months, the longest in the history of U.S. business cycles dating back to 1854. The previous record was held by the business expansion that lasted for 120 months from March 1991 to March 2001.And then - just two months later - in July 2020, the NBER called the end of the recession:

...

The usual definition of a recession involves a decline in economic activity that lasts more than a few months. However, in deciding whether to identify a recession, the committee weighs the depth of the contraction, its duration, and whether economic activity declined broadly across the economy (the diffusion of the downturn). The committee recognizes that the pandemic and the public health response have resulted in a downturn with different characteristics and dynamics than prior recessions. Nonetheless, it concluded that the unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions.

The committee has determined that a trough in monthly economic activity occurred in the US economy in April 2020. The previous peak in economic activity occurred in February 2020. The recession lasted two months, which makes it the shortest US recession on record.It will take some time for all major indicators to be above their previous high after the pandemic recession because of the severe contraction as the graphs below show. All of the following graphs show each measure as a percent of the previous peak.

...

In determining that a trough occurred in April 2020, the committee did not conclude that the economy has returned to operating at normal capacity. An expansion is a period of rising economic activity spread across the economy, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. Economic activity is typically below normal in the early stages of an expansion, and it sometimes remains so well into the expansion.

The committee decided that any future downturn of the economy would be a new recession and not a continuation of the recession associated with the February 2020 peak. The basis for this decision was the length and strength of the recovery to date.

GDP is the key measure, as the NBER committee notes in their business cycle dating procedure:

The committee views real GDP as the single best measure of aggregate economic activity.

Click on graph for larger image.

Click on graph for larger image.This graph is for real GDP through Q3 2021.

The previous high for real GDP was in Q4 2019.

Real GDP was above Q4 2019 levels in Q2 2021.

This was a very quick return to new highs, especially given the severity of the downturn. However, as NBER noted, this was the shortest recession on record (due to the pandemic).

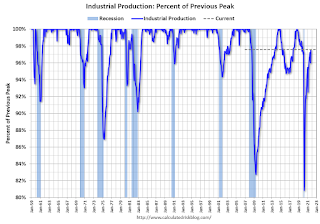

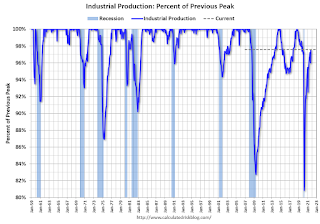

The second graph is for monthly industrial production based on data from the Federal Reserve through Oct 2021.

The second graph is for monthly industrial production based on data from the Federal Reserve through Oct 2021.

Industrial production is off 2.5% from the previous peak.

Note that industrial production was weak prior to the onset of the pandemic, and industrial production has recovered to the pre-pandemic level.

The third graph is for employment through October 2021.

The third graph is for employment through October 2021.

Historically employment was a coincident indicator for the end of recessions, but wasn't true for the previous three recessions (1990-1991, 2001, 2007-2009).

Employment is currently off about 2.8% from the pre-recession peak (dashed line). This is a significant improvement from off 14.7% in April 2020.

There is still ways to go for employment to recover to pre-pandemic levels.

And the last graph is for real personal income excluding transfer payments through September 2021.

And the last graph is for real personal income excluding transfer payments through September 2021.

Real personal income less transfer payments was still off slightly from the previous peak in September.

These graphs are useful in trying to identify peaks and troughs in economic activity.

Although economic activity bottomed in April 2020, only one of these four major indicators (GDP) is above the previous peak (although real personal income excluding transfer payments is close).

The second graph is for monthly industrial production based on data from the Federal Reserve through Oct 2021.

The second graph is for monthly industrial production based on data from the Federal Reserve through Oct 2021.Industrial production is off 2.5% from the previous peak.

Note that industrial production was weak prior to the onset of the pandemic, and industrial production has recovered to the pre-pandemic level.

The third graph is for employment through October 2021.

The third graph is for employment through October 2021.Historically employment was a coincident indicator for the end of recessions, but wasn't true for the previous three recessions (1990-1991, 2001, 2007-2009).

Employment is currently off about 2.8% from the pre-recession peak (dashed line). This is a significant improvement from off 14.7% in April 2020.

There is still ways to go for employment to recover to pre-pandemic levels.

And the last graph is for real personal income excluding transfer payments through September 2021.

And the last graph is for real personal income excluding transfer payments through September 2021.Real personal income less transfer payments was still off slightly from the previous peak in September.

These graphs are useful in trying to identify peaks and troughs in economic activity.

Although economic activity bottomed in April 2020, only one of these four major indicators (GDP) is above the previous peak (although real personal income excluding transfer payments is close).