Mortgage applications decreased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 17, 2021.

... The Refinance Index increased 2 percent from the previous week and was 42 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 9 percent lower than the same week one year ago.

“Mortgage applications fell last week, driven by a 3 percent decline in purchase applications. Both conventional and government purchase applications were down, while the average purchase loan increased for the second straight week to $416,200 – the second highest amount ever. The elevated loan size is an indication that activity is more on the higher end of the market,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Home-price appreciation growth remains faster than historical averages and inventory, particularly for starter homes, continues to trail strong demand.”

Added Kan, “The 30-year fixed rate decreased to 3.27 percent – its lowest level in four weeks – and helped spur an increase in refinances across all loan types. FHA and VA refinances jumped 4 percent and 12 percent, respectively.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.27 percent from 3.30 percent, with points increasing to 0.41 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

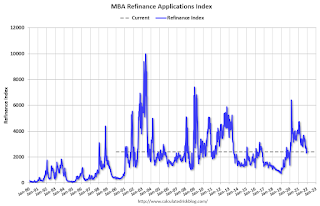

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains slightly elevated, but down sharply from last year.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 9% year-over-year unadjusted.

According to the MBA, purchase activity is down 9% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).