by Calculated Risk on 1/12/2022 07:00:00 AM

Wednesday, January 12, 2022

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 7, 2022. The previous week’s results included an adjustment for the holidays.

... The Refinance Index decreased 0.1 percent from the previous week and was 50 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 51 percent compared with the previous week and was 17 percent lower than the same week one year ago.

“Mortgage rates increased significantly across all loan types last week as the Federal Reserve’s signaling of tighter policy ahead pushed U.S. Treasury yields higher. The 30-year fixed rate hit 3.52 percent, its highest level since March 2020. Rates at these levels are quickly closing the door on refinance opportunities for many borrowers. Although refinance activity changed little over the week, applications remained at their lowest level in over a month, and conventional refinance applications were at their lowest level since January 2020,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The housing market started 2022 on a strong note. Both conventional and government purchase applications showed increases, with FHA purchase applications increasing almost 9 percent, and VA applications increasing more than 5 percent. MBA expects solid growth in purchase activity this year, as demographic drivers and the strong economy support housing demand. However, the strength in growth will be dependent on housing inventory growing more rapidly to meet demand.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 3.52 percent from 3.33 percent, with points decreasing to 0.45 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

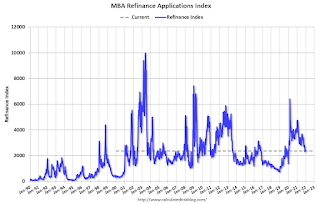

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index will probably decline sharply next week.

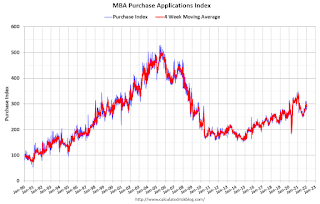

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 17% year-over-year unadjusted.

According to the MBA, purchase activity is down 17% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).