by Calculated Risk on 3/21/2022 09:00:00 PM

Monday, March 21, 2022

Tuesday: Richmond Fed Mfg

From Matthew Graham at Mortgage News Daily: From Bad to Worse as Powell Doubles Down on Policy Shift

Things were already fairly ugly this morning as the bond market opted to pay no attention to last Friday's consolidation potential. Fed Funds Futures showed the market pricing in at least one 50bp hike in addition to a 25bp hike at every remaining Fed meeting this year. Powell's scheduled speech added a significant amount of fuel to that fire at 12:30pm. He did nothing to try to calm the market down, but instead, essentially told traders they were correct in rushing to price in more rate hikes and faster policy normalization. This resulted in overnight losses more than doubling across the curve, and widespread negative reprices. [30 year fixed 4.66%]Tuesday:

emphasis added

• At 10:00 AM ET, Richmond Fed Survey of Manufacturing Activity for March.

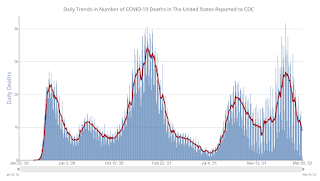

On COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Percent fully Vaccinated | 65.4% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 217.1 | --- | ≥2321 | |

| New Cases per Day3 | 27,786 | 33,721 | ≤5,0002 | |

| Hospitalized3 | 18,203 | 25,105 | ≤3,0002 | |

| Deaths per Day3 | 901 | 1,187 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of deaths reported.