by Calculated Risk on 4/01/2022 09:18:00 AM

Friday, April 01, 2022

Comments on March Employment Report

This was another solid report.

The headline jobs number in the March employment report was slightly below expectations, however employment for the previous two months was revised up by 95,000. The participation rate and the employment-population ratio both increased, and the unemployment rate decreased to 3.6%.

Leisure and hospitality gained 112 thousand jobs in March. At the beginning of the pandemic, in March and April of 2020, leisure and hospitality lost 8.20 million jobs, and are now down 1.47 million jobs since February 2020. So, leisure and hospitality has now added back about 82% all of the jobs lost in March and April 2020.

Construction employment increased 19 thousand and is now 4 thousand above the pre-pandemic level.

Manufacturing added 38 thousand jobs and is still 118 thousand below the pre-pandemic level.

Earlier: March Employment Report: 431 thousand Jobs, 3.6% Unemployment Rate

In March, the year-over-year employment change was 6.5 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.

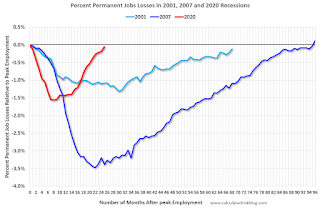

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

In March, the year-over-year employment change was 6.5 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

This data is only available back to 1994, so there is only data for three recessions.

In March, the number of permanent job losers decreased to 1.392 million from 1.583 million in the previous month.

In March, the number of permanent job losers decreased to 1.392 million from 1.583 million in the previous month.

These jobs will likely be the hardest to recover, so it is a positive that the number of permanent job losers is almost back to pre-recession levels.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in March to 82.5% from 82.2% in February, and the 25 to 54 employment population ratio increased to 80.0% from 79.5% the previous month.

Both are slightly below the pre-pandemic levels and indicate almost all of the prime age workers have returned to the labor force.

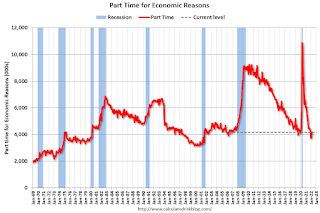

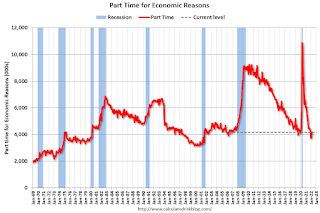

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 6.9% from 7.2% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is below the 7.0% in February 2020 (pre-pandemic).

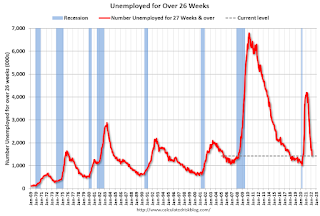

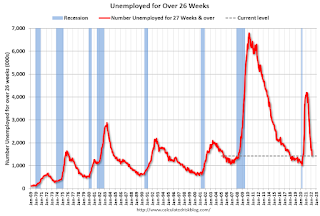

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, there are 1.702 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.691 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was slightly below expectations; however, the previous two months were revised up by 95,000 combined.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons was about unchanged at 4.2 million in March and is little different from its February 2020 level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in March to 4.170 million from 4.135 million in February. This is at pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 6.9% from 7.2% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is below the 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.702 million workers who have been unemployed for more than 26 weeks and still want a job, up from 1.691 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was slightly below expectations; however, the previous two months were revised up by 95,000 combined.

The headline unemployment rate decreased to 3.6%. The household survey indicated a strong gain in employment of 736 thousand, pushing up the participation rate and employment-population ratio, and pushing down the unemployment rate to 3.6%, and U-6 to below pre-recession levels.

Both the prime age participation rate and employment-population ratio increased, and are now close to pre-pandemic levels, indicating almost all of the prime age workers have returned to the labor force.

There are still 1.6 million fewer jobs than prior to the recession.

Overall, this was another solid report.