by Calculated Risk on 5/03/2022 03:23:00 PM

Tuesday, May 03, 2022

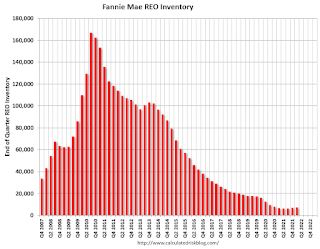

Fannie REO inventory increased in Q1 year-over-year; Expected to increase further in 2022

Fannie reported results for Q1 2022. Here is some information on single-family Real Estate Owned (REOs).

Here is a note on the pandemic impact on foreclosures, from Fannie:

"In response to the pandemic and with instruction from FHFA, we prohibited our servicers from completing foreclosures on our single-family loans through July 31, 2021, except in the case of vacant or abandoned properties. In addition, our servicers were required to comply with a Consumer Financial Protection Bureau (the “CFPB”) rule that prohibited certain new single-family foreclosures on mortgage loans secured by the borrower’s principal residence until after December 31, 2021. As a result, our foreclosure volumes were slightly higher in the first quarter of 2022 compared with the first quarter of 2021. We expect foreclosure volumes to gradually increase throughout 2022.

In April 2022, FHFA announced a suspension of foreclosure activities for up to 60 days for borrowers who apply for assistance under Treasury’s Homeowner Assistance Fund." emphasis added

Fannie Mae reported the number of REO increased to 7,430 at the end of Q1 2022 compared to 6,918 at the end of Q1 2021.

For Fannie, this is down 96% from the 166,787 peak number of REOs in Q3 2010.

Click on graph for larger image.

Click on graph for larger image.

Here is a graph of Fannie Real Estate Owned (REO).

REO inventory increased in Q1 2022, and inventory is up 7% year-over-year.

This is well below a normal level of REOs for Fannie, and REO levels will increase in 2022 now that the moratorium is over, but there will not be a huge wave of foreclosures.

For Fannie, this is down 96% from the 166,787 peak number of REOs in Q3 2010.

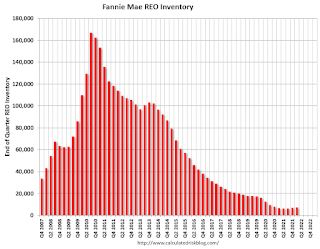

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie Real Estate Owned (REO).

REO inventory increased in Q1 2022, and inventory is up 7% year-over-year.

This is well below a normal level of REOs for Fannie, and REO levels will increase in 2022 now that the moratorium is over, but there will not be a huge wave of foreclosures.