by Calculated Risk on 5/09/2022 02:06:00 PM

Monday, May 09, 2022

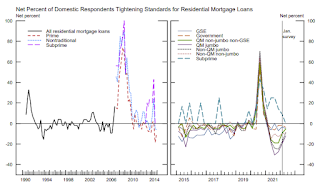

Fed Survey: Banks reported Eased Standards, Weaker Demand for Residential Real Estate Loans

From the Federal Reserve: The April 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices

The April 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the first quarter of 2022.

Regarding loans to businesses, respondents to the survey reported, on balance, unchanged standards for commercial and industrial (C&I) loans to firms of all sizes, after having eased them over the previous four quarters, while demand strengthened over the first quarter. Meanwhile, banks reported unchanged standards and demand for most commercial real estate (CRE) loan categories except for those secured by multifamily residential properties, for which they eased standards and demand strengthened on net.

Banks also responded to a set of special questions about changes in lending policies and demand for CRE loans over the past year. Banks reportedly eased some lending terms across all CRE loan categories, including the maximum loan size and maturity, the spread of loan rates over their cost of funds, the length of interest-only periods, and the market areas served.

For loans to households, banks eased standards across most categories of residential real estate (RRE) loans and home equity lines of credit (HELOCs) over the first quarter, while also reporting weaker demand for all types of RRE loans but stronger demand for HELOCs on net. In addition, banks eased standards for card loans and auto loans, while demand reportedly strengthened for all consumer loan types over the first quarter

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate lending is from the Senior Loan Officer Survey Charts.

This shows that banks have eased standards for residential real estate.

The second graph shows demand for residential real estate.

This was was Q1. Demand is probably dropping sharply in Q2.

This was was Q1. Demand is probably dropping sharply in Q2.