by Calculated Risk on 5/08/2022 09:49:00 AM

Sunday, May 08, 2022

Vehicle Sales Mix and Heavy Trucks

It will be interesting to see if high gasoline prices will lead to a higher percentage of passenger car sales.

This graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs through April 2022.

Over time the mix has changed more and more towards light trucks and SUVs.

Over time the mix has changed more and more towards light trucks and SUVs.Only when oil prices are high, does the trend slow or reverse.

The percent of light trucks and SUVs was at 79.0% in April 2022 - just below the record high percentage of 80.0% last October.

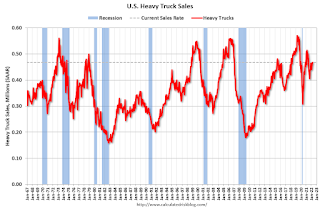

The second graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the April 2022 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 563 thousand SAAR in September 2019.

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand SAAR in May 2009. Then heavy truck sales increased to a new all-time high of 563 thousand SAAR in September 2019.Note: "Heavy trucks - trucks more than 14,000 pounds gross vehicle weight."

Heavy truck sales really declined at the beginning of the pandemic, falling to a low of 299 thousand SAAR in May 2020.

Heavy truck sales were at 467 thousand SAAR in April, unchanged from March, and down 3% from 482 thousand SAAR in April 2021.

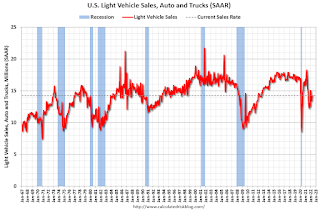

The last graph shows light vehicle sales since the BEA started keeping data in 1967. The BEA reported sales of 14.29 million SAAR in April 2022 (Seasonally Adjusted Annual Rate), up 6.6% from the March sales rate, and down 21.9% from April 2021.

The last graph shows light vehicle sales since the BEA started keeping data in 1967. The BEA reported sales of 14.29 million SAAR in April 2022 (Seasonally Adjusted Annual Rate), up 6.6% from the March sales rate, and down 21.9% from April 2021.The impact of COVID-19 was significant, and April 2020 was the worst month. After April 2020, sales increased, and were close to sales in 2019 (the year before the pandemic).

However, sales decreased late last year due to supply issues. It appears the "supply chain bottom" was in September 2021, and sales in April were above the consensus forecast of 13.8 million SAAR.

Sales are still weak but picking up.