by Calculated Risk on 6/03/2022 09:31:00 AM

Friday, June 03, 2022

Comments on May Employment Report

The headline jobs number in the May employment report was above expectations, however employment for the previous two months was revised down by 22,000. The participation rate and the employment-population ratio both increased slightly, and the unemployment rate was unchanged at 3.6%.

Excluding leisure and hospitality, the economy has more than added back all the jobs lost at the beginning of the pandemic. Leisure and hospitality gained 84 thousand jobs in May. At the beginning of the pandemic, in March and April of 2020, leisure and hospitality lost 8.20 million jobs, and are now down 1.35 million jobs since February 2020. So, leisure and hospitality has now added back about 84% all of the jobs lost in March and April 2020.

Construction employment increased 36 thousand and is now 40 thousand above the pre-pandemic level.

Manufacturing added 18 thousand jobs and is just 17 thousand below the pre-pandemic level.

Earlier: May Employment Report: 390 thousand Jobs, 3.6% Unemployment Rate

In May, the year-over-year employment change was 6.5 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.

This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

In May, the year-over-year employment change was 6.5 million jobs.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today.

This data is only available back to 1994, so there is only data for three recessions.

In May, the number of permanent job losers was unchanged at 1.386 million from 1.386 million in the previous month.

In May, the number of permanent job losers was unchanged at 1.386 million from 1.386 million in the previous month.

These jobs were likely the hardest to recover, so it is a positive that the number of permanent job losers is essentially back to pre-recession levels.

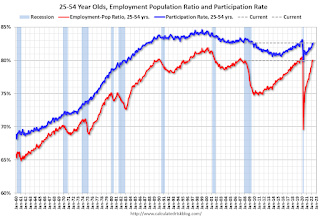

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The 25 to 54 participation rate increased in May to 82.6% from 82.4% in April, and the 25 to 54 employment population ratio increased to 80.0% from 79.9% the previous month.

Both are slightly below the pre-pandemic levels and indicate almost all of the prime age workers have returned to the labor force.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.1% from 7.0% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is close to the 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more.

According to the BLS, there are 1.356 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.483 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was above expectations; however, the previous two months were revised down by 22,000 combined.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons increased by 295,000 to 4.3 million in May, reflecting an increase in the number of persons whose hours were cut due to slack work or business conditions. The number of persons employed part time for economic reasons is little different from its February 2020 level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons increased in May to 4.328 million from 4.033 million in April. This is at pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 7.1% from 7.0% in the previous month. This is down from the record high in April 22.9% for this measure since 1994. This measure is close to the 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.356 million workers who have been unemployed for more than 26 weeks and still want a job, down from 1.483 million the previous month.

This does not include all the people that left the labor force.

Summary:

The headline monthly jobs number was above expectations; however, the previous two months were revised down by 22,000 combined.

The headline unemployment rate was unchanged at 3.6%.

There are still 0.8 million fewer jobs than prior to the recession.

Overall, this was another strong report.