by Calculated Risk on 6/06/2022 08:35:00 AM

Monday, June 06, 2022

Four High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Note: Apple has discontinued "Apple mobility", and restaurant traffic is mostly back to normal.

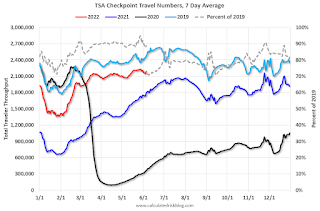

The TSA is providing daily travel numbers.

This data is as of June 5th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 12.4% from the same day in 2019 87.6% of 2019). (Dashed line)

Air travel has been moving sideways over the last three months, off about 10% from 2019.

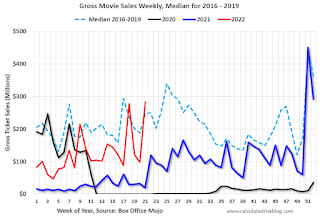

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Black is 2020, Blue is 2021 and Red is 2022.

The data is from BoxOfficeMojo through June 2nd.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $284 million last week, up about 15% from the median for the week - due primarily to the release of Top Gun.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $284 million last week, up about 15% from the median for the week - due primarily to the release of Top Gun.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through May 28th. The occupancy rate was up 3.2% compared to the same week in 2019.

The 4-week average of the occupancy rate is at the median rate for the previous 20 years (Blue).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This was the first increase in the occupancy rate compared to the same week in 2019. This was partly due to the timing of Memorial Day, and I expect the occupancy rate to be down compared to 2019 next week.

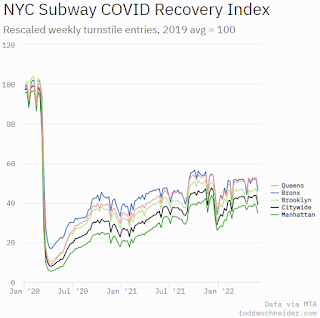

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This graph shows how much MTA traffic has recovered in each borough (Graph starts at first week in January 2020 and 100 = 2019 average).

Manhattan is at about 39% of normal.

This data is through Friday, June 3rd.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".