by Calculated Risk on 7/18/2022 10:07:00 AM

Monday, July 18, 2022

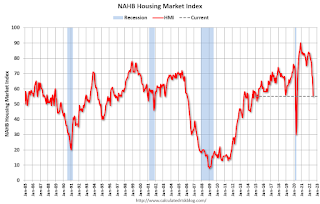

NAHB: Builder Confidence "Plunges" to 55 in July

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 55, down from 67 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

From the NAHB: Builder Confidence Plunges as Affordability Woes Mount

Builder confidence plunged in July as high inflation and increased interest rates stalled the housing market by dramatically slowing sales and buyer traffic. In a further sign of a weakening housing market, builder confidence in the market for newly built single-family homes posted its seventh straight monthly decline in July, falling 12 points to 55, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. This marks the lowest HMI reading since May 2020 and the largest single-month drop in the history of the HMI, except for the 42-point drop in April 2020.

“Production bottlenecks, rising home building costs and high inflation are causing many builders to halt construction because the cost of land, construction and financing exceeds the market value of the home,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “In another sign of a softening market, 13% of builders in the HMI survey reported reducing home prices in the past month to bolster sales and/or limit cancellations.”

“Affordability is the greatest challenge facing the housing market,” said NAHB Chief Economist Robert Dietz. “Significant segments of the home buying population are priced out of the market. Policymakers must address supply-side issues to help builders produce more affordable housing.”

...

All three HMI components posted declines in July: Current sales conditions dropped 12 points to 64, sales expectations in the next six months declined 11 points to 50 and traffic of prospective buyers fell 11 points to 37.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell six points to 65, the Midwest dropped four points to 52, the South fell eight points to 70 and the West posted a 12-point decline to 62.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was well below the consensus forecast, but still above 50.

The "traffic of prospective buyers" is now well below breakeven at 37 (below 50).