by Calculated Risk on 7/21/2022 10:29:00 AM

Thursday, July 21, 2022

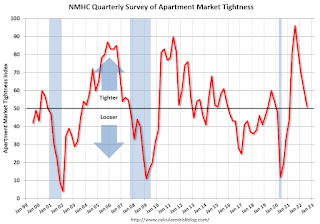

NMHC: July Apartment Market Survey shows "Barely" Tighter Conditions

From the National Multifamily Housing Council (NMHC): Higher Interest Rates Begin to Impact Multifamily

Apartment sales volume fell while both equity and debt financing became more costly, according to the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for July 2022. However, demand in most markets was still strong relative to supply.

“Continued interest rate hikes from the Fed have translated into higher longer-term rates and a higher cost of both debt and equity,” noted NMHC’s Chief Economist, Mark Obrinsky. “While these higher rates have cut into investor proceeds, many sellers are reluctant to lower prices, causing a sharp drop in sales volume.”

“The apartment market recorded its sixth consecutive quarter of tightening conditions, if just barely. Fifty-six percent of respondents reported unchanged conditions, while those reporting tighter conditions slightly outpaced those reporting looser market conditions.”

...

Market Tightness Index came in at 51, just above the breakeven level of 50. This indicates that market conditions have become tighter, albeit with considerable variation by market. Twenty-three percent of respondents reported markets to be tighter than three months ago compared to 21% of respondents who observed looser conditions in the markets they watch. Meanwhile, over half of respondents (56%) thought that apartment market conditions were unchanged from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Even though the index declined in July, this indicates market conditions tightened slightly in July for the sixth consecutive quarter.

This suggests rent growth will slow.