by Calculated Risk on 9/05/2022 08:21:00 AM

Monday, September 05, 2022

Four High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides. Notes: I've added back gasoline supplied to see if there is an impact from higher gasoline prices.

The TSA is providing daily travel numbers.

This data is as of September 4th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2022 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 3.4% from the same day in 2019 (90.9% of 2019). (Dashed line)

Air travel - as a percent of 2019 - had been moving sideways over the last several months, off about 10% from 2019. Travel has picked up recently, compared to 2019, perhaps due to the timing of Labor Day.

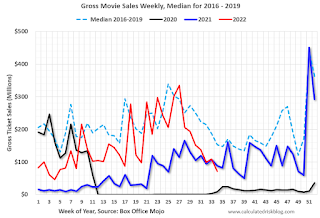

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Black is 2020, Blue is 2021 and Red is 2022.

The data is from BoxOfficeMojo through September 1st.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $78 million last week, down about 53% from the median for the week.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $78 million last week, down about 53% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

This data is through August 27th. The occupancy rate was down 2.5% compared to the same week in 2019.

The 4-week average of the occupancy rate is close to the median rate for the previous 20 years (Blue).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

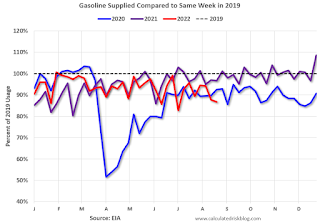

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

Blue is for 2020. Purple is for 2021, and Red is for 2022.

As of August 26th, gasoline supplied was down 13.2% compared to the same week in 2019.

Recently gasoline supplied has been running below 2019 and 2021 levels - and sometimes below 2020.