For manufacturing, August Industrial Production, and the September New York and Philly Fed surveys, will be released this week.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for August.

8:30 AM: The Consumer Price Index for August from the BLS. The consensus is for a 0.1% decrease in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 8.1% year-over-year and core CPI to be up 6.1% YoY.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.3% increase in core PPI.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an increase to 225 thousand from 222 thousand last week.

8:30 AM ET: Retail sales for August will be released. The consensus is for a 0.2% increase in retail sales.

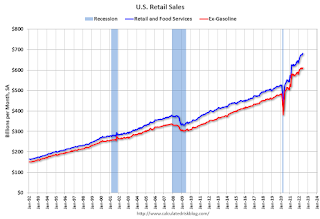

8:30 AM ET: Retail sales for August will be released. The consensus is for a 0.2% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 3.5, down from 6.2.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of -13.9, up from -31.3.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

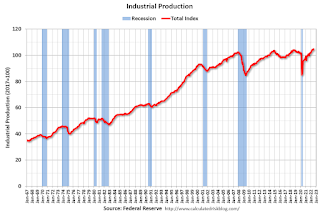

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 80.3%.

10:00 AM: State Employment and Unemployment (Monthly) for August 2022

0:00 AM: University of Michigan's Consumer sentiment index (Preliminary for September).