by Calculated Risk on 11/09/2022 07:00:00 AM

Wednesday, November 09, 2022

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

— Mortgage applications decreased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 4, 2022.

... The Refinance Index decreased 4 percent from the previous week and was 87 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 41 percent lower than the same week one year ago.

“Mortgage rates edged higher last week following news that the Federal Reserve will continue raising short-term rates to combat high inflation. The 30-year fixed rate remained above 7 percent for the third consecutive week, with increases for most loan types,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications increased for the first time after six weeks of declines but remained close to 2015 lows, as homebuyers remained sidelined by higher rates and ongoing economic uncertainty. Refinances continued to fall, with the index hitting its lowest level since August 2000.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 7.14 percent from 7.06 percent, with points increasing to 0.77 from 0.73 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

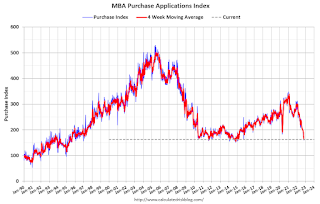

Click on graph for larger image.The first graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index has declined sharply this year.

The refinance index is at the lowest level since the year 2000.

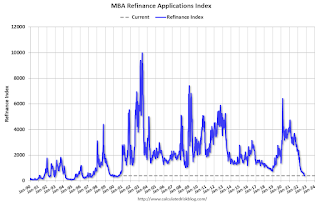

The second graph shows the MBA mortgage purchase index

The purchase index is 11% below the pandemic low and near the lowest level since 2015.

Note: Red is a four-week average (blue is weekly).

Note: Red is a four-week average (blue is weekly).