by Calculated Risk on 12/31/2022 08:11:00 AM

Saturday, December 31, 2022

Schedule for Week of January 1, 2023

Happy New Year! Wishing you all the best in 2023.

The key report this week is the December employment report on Friday.

Other key indicators include the December ISM manufacturing, December vehicle sales, the November trade deficit, and November Job Openings.

The NYSE and the NASDAQ will be closed in observance of the New Year’s Day holiday

8:00 AM ET: Corelogic House Price index for November.

10:00 AM: Construction Spending for November. The consensus is for a 0.4% decrease in construction spending.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS.

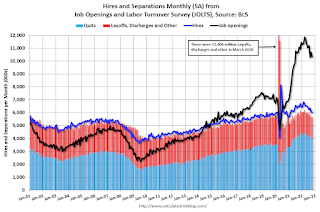

10:00 AM ET: Job Openings and Labor Turnover Survey for October from the BLS. This graph shows job openings (black line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in October to 10.334 million from 10.687 million in September

10:00 AM: ISM Manufacturing Index for December. The consensus is for the ISM to be at 48.5, down from 49.0 in November.

2:00 PM: FOMC Minutes, Meeting of December 13-14, 2022

All day: Light vehicle sales for December.

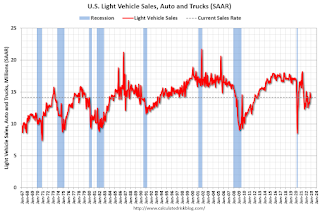

All day: Light vehicle sales for December.The Wards forecast is for 13.0 million SAAR in December, down from the BEA estimate of 14.1 million SAAR in November (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

8:15 AM: The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 145,000, up from 127,000 jobs added in November.

8:30 AM: Trade Balance report for November from the Census Bureau.

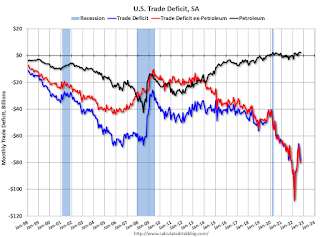

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $76.1 billion. The U.S. trade deficit was at $78.2 billion in October.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 225 thousand last week.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.

8:30 AM: Employment Report for November. The consensus is for 200,000 jobs added, and for the unemployment rate to be unchanged at 3.7%.There were 263,000 jobs added in November, and the unemployment rate was at 3.7%.

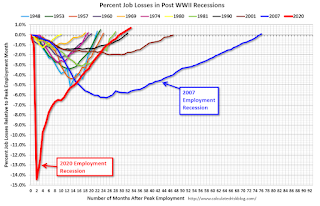

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, as of August 2022, the total number of jobs had returned and are now 1.044 million above pre-pandemic levels.

10:00 AM: the ISM Services Index for December.