by Calculated Risk on 1/23/2023 04:00:00 PM

Monday, January 23, 2023

MBA Survey: "Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in December"

Note: This is as of December 31st.

From the MBA: Share of Mortgage Loans in Forbearance Remains Flat at 0.70% in December

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance remained flat relative to the prior month at 0.70% as of December 31, 2022. According to MBA’s estimate, 350,000 homeowners are in forbearance plans.

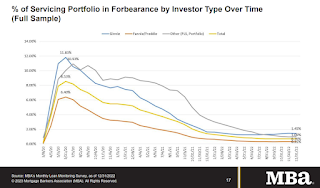

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 1 basis point to 0.31%. Ginnie Mae loans in forbearance decreased 1 basis point to 1.45%, and the forbearance share for portfolio loans and private-label securities (PLS) increased 3 basis points to 1.00%.

“For three consecutive months, the forbearance rate has remained flat — an indicator that we may have reached a floor on further improvements,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “New forbearance requests and re-entries continue to trickle in at about the same pace as forbearance exits. The overall performance of servicing portfolios was also flat compared to the previous month, but there was some deterioration in the performance of Ginnie Mae loans.”

Added Walsh, “Forbearance remains an option for struggling homeowners and its usage may continue, especially if unemployment increases as expected. MBA is forecasting for the unemployment rate to reach 5.2 percent in the second half of 2023, up from its current level of 3.5 percent.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time.

The share of forbearance plans had been decreasing, although the percent in forbearance was unchanged in November and December.

At the end of December, there were about 350,000 homeowners in forbearance plans.